New-age customers are increasingly sharing their information to get personalized and innovative services. It’s up to the banks and financial institutions how to use this data (extra) judiciously and deliver a well-thought-out customer-centric user experience.

As banks, credit unions, mortgage & asset management companies, and other such BFS organizations gain more customers, they get direct access to massive historic and real-time data on the customers’ transactions, account information, spending patterns, credit information, and more. They have information on customers’ salaries, other monthly income, loans, and where their liabilities are. Now, what’s left is to make good sense of this data.

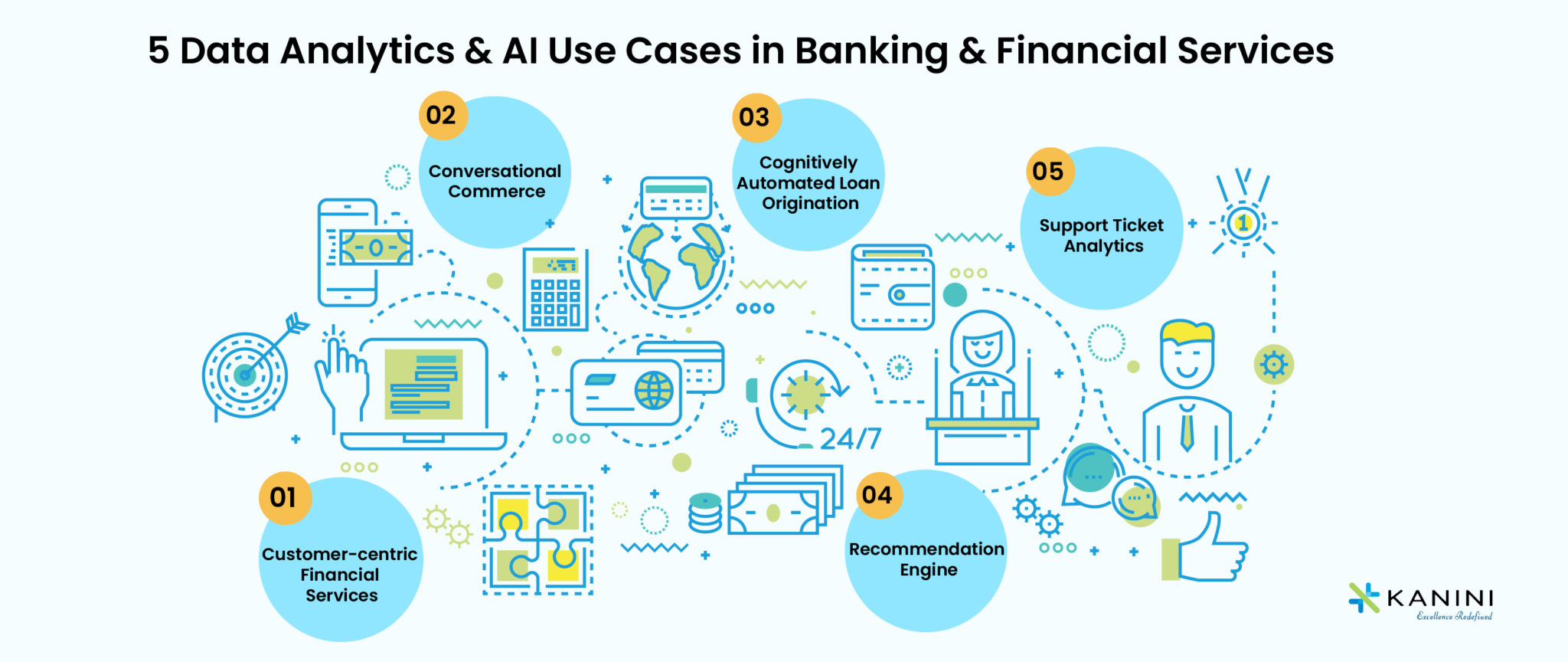

5 Data Analytics & AI Use Cases in Building a Customer-centric Business Model

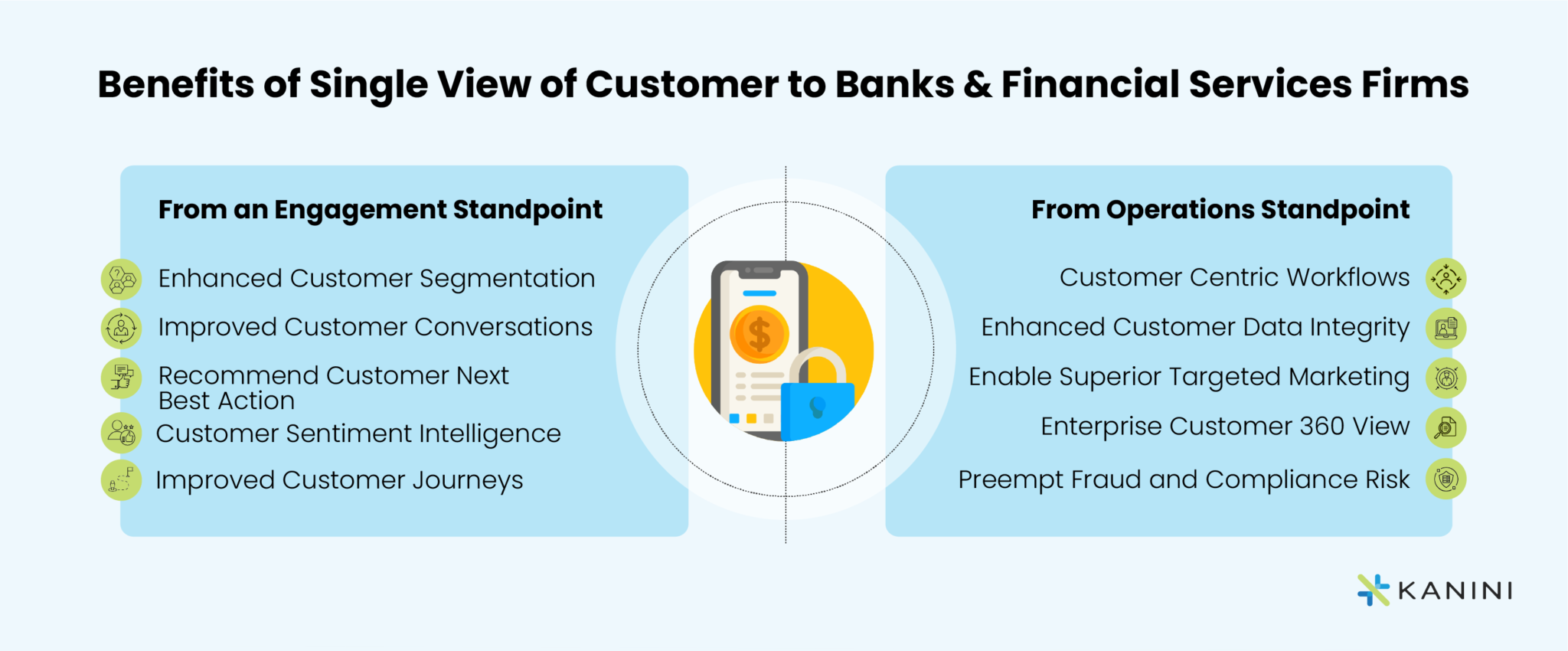

1. Customer-centric Financial Services – Single View of a Customer

- A Scalable, Reliable, Secure Data Platform that seamlessly collects, cleans, and integrates federated customer data from various source systems to create a “Single View of a Customer”.

- A Customer Hub for customer profile data (name, social, preferences), transactional data (account level transactions aggregated at a daily, monthly frequency), customer feedback data, customer touchpoint metrics and any external information (social network) received upon customer consent.

- “Customer First; Money Next” Culture to empower employees with a clear understanding of who their customers are.

- Leverage big data with cloud infrastructure to bring down platform costs and scale predictably.

2. Conversational Commerce

Conversational AI is a game-changer for banks, lending organizations, and all financial institutions for that matter. When implemented correctly, conversational AI can improve customer engagement dramatically. Live Chat Apps, Chatbots, Voice Assistants, and Messaging Apps are all types of conversational commerce and classic examples of the revolutionary role of AI in the banking and financial services industry today.

Conversational commerce can help in:

- Understanding customer behavior based on their conversational transactions

- Recommending relevant suggestions based on peer customer interactions

- Acting as an ‘Always-Available Virtual Agent’ or a ‘Banking Buddy’, improving customer online banking experience

- Gaining insights on a customer’s utilization of banking features, improved spend analytics, etc.

Want to learn more about the role of data analytics and AI in streamlining banking operations?

3. Cognitively Automated Loan Origination System

- Protect yourself and your users from fraud

- Predict the loan eligibility of a customer

- Predict the loan default possibility of a customer

- Build a financial assistant to serve customers at scale to handle millions of queries efficiently

- Carry out faster document verifications, KYC, and loan approvals

4. Recommendation Engine – Next-best Action for Customers

When discussing the top use cases of data analytics and AI in banking and financial services, recommendation engines cannot be missed. AI-powered recommender systems can be used to identify and suggest the most relevant and valuable offers, services, or products to customers.

Enterprises can also do a product association analysis to understand the relationship between different products and suggest complementary products or services. Through such tailored recommendations, banks and financial institutions can significantly improve customer experience and engagement, purchase frequency, and revenue.

5. Support Ticket Analytics

- Valuable Insights – Providing intelligence on aspects such as the number of incidents and service requests, customer satisfaction, customer experience, first contact resolution, the average resolution time, escalations, bounce rate, average cost per incident, etc.

- Decision Intelligence that helps –

- Predict the resolution time for a ticket based on past ticket data

- Predict the priority of a service

- Predict future ticket volume

- Suggest similar resolutions to service engineering for faster resolutions

- Predict the average cost of resolution for a specific request type

- 3. Cognitive Automation

- Automate ticket resolution based on decision intelligence

- Provide rapid resolution of tickets

Wrapping Up

With the five use cases of data analytics and AI in the banking and financial services sector discussed above, it is evident that data transformation is becoming central in improving efficiency, resilience, and customer experience and also reducing costs. Customers today are a lot more informed and have more choices than ever. They are aware of the usage of Data Analytics & AI in the banking and financial services industry and expect innovative products and enhanced services. It is essential for these banking and financial services firms now to embrace data transformation initiatives to stand apart from the competition and deliver above everyone else.

At KANINI, we can guide you in your data transformation journey with our expertise in leveraging data analytics, intelligent automation, and AI for the banking and financial services sector. Contact us to know more.

Author

Anand Subramaniam

Anand Subramaniam is the Chief Solutions Officer, leading Data Analytics & AI service line at KANINI. He is passionate about data science and has championed data analytics practice across start-ups to enterprises in various verticals. As a thought leader, start-up mentor, and data architect, Anand brings over two decades of techno-functional leadership in envisaging, planning, and building high-performance, state-of-the-art technology teams.