The COVID-19 pandemic has been a significant accelerator in the growth of ESG. The market disruptions and uncertainties during the pandemic triggered investors to look for ESG funds for increasing resiliency.

- A report by Bank of America Global Research found that ESG funds saw a record $51.2 billion in inflows in 2020, a more than four-fold increase from the previous year.

- According to data from BlackRock, ESG-themed ETFs saw inflows of $20.6 billion in 2020, an increase of 70% compared to the previous year.

Challenges in Achieving ESG Goals

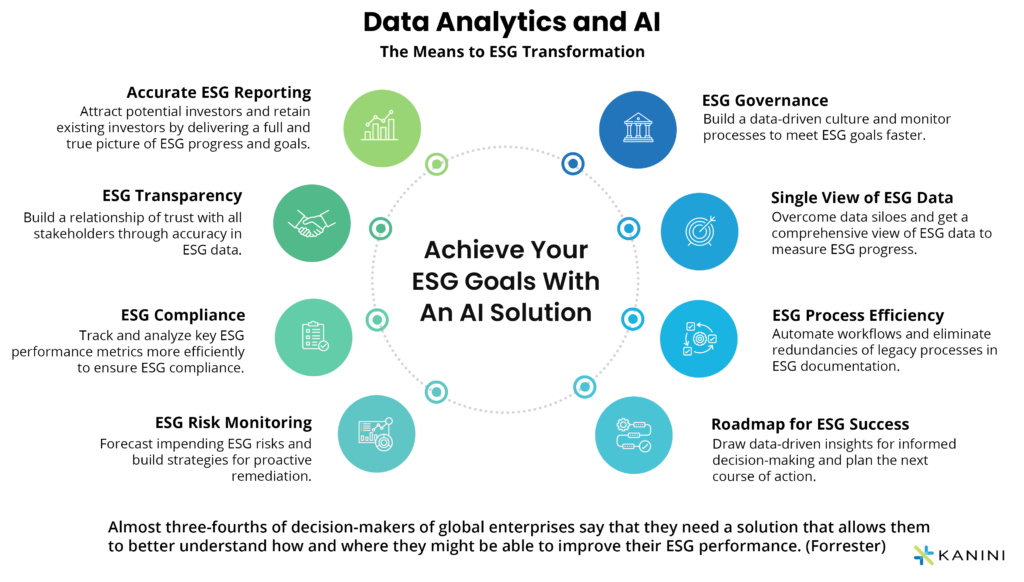

Accomplishing ESG Goals with Data Analytics and AI

Want to automate your ESG Audits?

Read the Case Study to learn how fully customizable AI-powered ESG audit solutions can transform your ESG audit processes to save you time and costs.

Final Thoughts

Author

Anand Subramaniam

Anand Subramaniam is the Chief Solutions Officer, leading Data Analytics & AI service line at KANINI. He is passionate about data science and has championed data analytics practice across start-ups to enterprises in various verticals. As a thought leader, start-up mentor, and data architect, Anand brings over two decades of techno-functional leadership in envisaging, planning, and building high-performance, state-of-the-art technology teams.