It’s the age of sustainable investing and ESG is one of the most talked about topics in the corporate world today. The new generation of ‘socially responsible’ investors and millennials want to invest in companies that drive a positive change and therefore, there is a need for businesses to align their strategies to ESG principles, that is if they haven’t already.

In our last blog on ESG, we took you through what ESG is all about and how enterprises across the world are ensuring they are in adherence to Environmental, Social, and Governance factors, the non-financial factors, in their business principles and operations. And, even more so after COVID-19, which has been one of the major accelerators in companies evolving into socially responsible corporate citizens.

In the United States, although ESG disclosures haven’t yet been formally regulated, recent legislation passed by the House of Representatives requires public companies to submit their annual and quarterly ESG reports.

Evaluating and monitoring ESG actions and statements using structured audit processes is therefore imperative for organizations. Companies need to identify and address material risks and growth opportunities in ESG for accurate reporting and compliance, and to be on the same page with this new generation of impact investors.

AI Drives Modern-Day ESG Audits

In the present-day scenario where technology makes the unimaginable possible, the auditing process has also benefited greatly from the Midas touch of technology. The days of manual audits are over, given how exhausting, inaccurate, and time-intensive the manual process is. Artificial Intelligence, covering Data Mining, Machine Learning, Image Recognition, Speech Recognition, and Sentiment Analysis, has made way for far more efficient and accurate auditing so that organizations can plan their ESG roadmap and achieve their ESG goals smartly.

Use Case: How an Audit Firm Leveraged AI to Ensure ESG Readiness for Its Clients

ESG auditing requires an in-depth analysis of an organization’s documents – current and past – by experts who are much better equipped to do that when they have the support of the right technology. For accurate risk assessment and high-quality audit delivery, auditing practitioners need to score items – not just pass or fail them. And this task in itself becomes a challenge when there is no technology-driven software in place

An AI-powered ESG Audit Platform’s scoring capability makes the audit far more foolproof as well as future-proof. Using advanced tools and techniques such as NLP, Databricks, spaCy and more, the platform classifies documents; extracts key entities; searches and retrieves contextual matches with ESG standards, topics, and requirements; provides text analytics; and accepts feedback – all to deliver an accurate ESG score.

Let’s take you through a use case to give you an overview of how the most complex Requirement Completion Scoring Process becomes seamless and accurate when powered by AI –

Amidst the backdrop of rising ESG consciousness, an audit firm in Texas had quite a few clients coming in for their ESG audits.

The requirement was clear. They wanted to carry out accurate ESG audits for them, within a stipulated time frame, to establish their ESG readiness score.

But the challenge was that the audit firm was still using age-old manual auditing processes. This meant practitioners were going through piles of CSR documents and 10-K and 8-K reports provided by their clients manually to mine information on ESG requirement compliance and completing extensive documentation to arrive at an ESG readiness score. In this manual requirement completion scoring process, the auditing practitioners were struggling to adhere to the GRI / SASB requirements and facing numerous challenges like the following –

- The documents presented by clients were very extensive and in diverse formats

- Information mining was tedious and time-consuming

- The exact match of what the practitioner was expecting was often unavailable

- It was a challenge for practitioners to gather information in a consistent manner

- There was no way to create cross-references or set protocols to identify/rectify similar document inconsistencies in the future

- Practitioners had to note down valuable data presented in the form of diagrams (charts/ infographics/ tables etc.) manually and later correlate

- There were inconsistencies in scoring between two auditors of the same firm

- Comparing multiple document sets and drawing inferences from historical data was a challenge. This meant repeated auditing efforts to measure client compliance every time.

The outcome was obvious. Exhausted auditing practitioners, inaccurate/inconclusive scoring, and dissatisfied clients. Their leadership soon realized that it was impossible to stay in the competition this way and that there was a need to bring in a radical change. They turned to AI-powered auditing solutions for ESG audits.

Using AI for making decisions on requirement compliance as well as cognitively automating the process of classifying documents as per GRI/SASB, extracting specific entities / information from CSR and other external documents like 10-K reports was a great decision. The advanced ESG Audit Platform helped the firm build a robust reputation over time and they were able to deliver on ESG audits at-scale.

Want to automate your ESG Audits?

Read the Case Study to learn how fully customizable AI-powered ESG audit solutions can transform your ESG audit processes to save you time and costs.

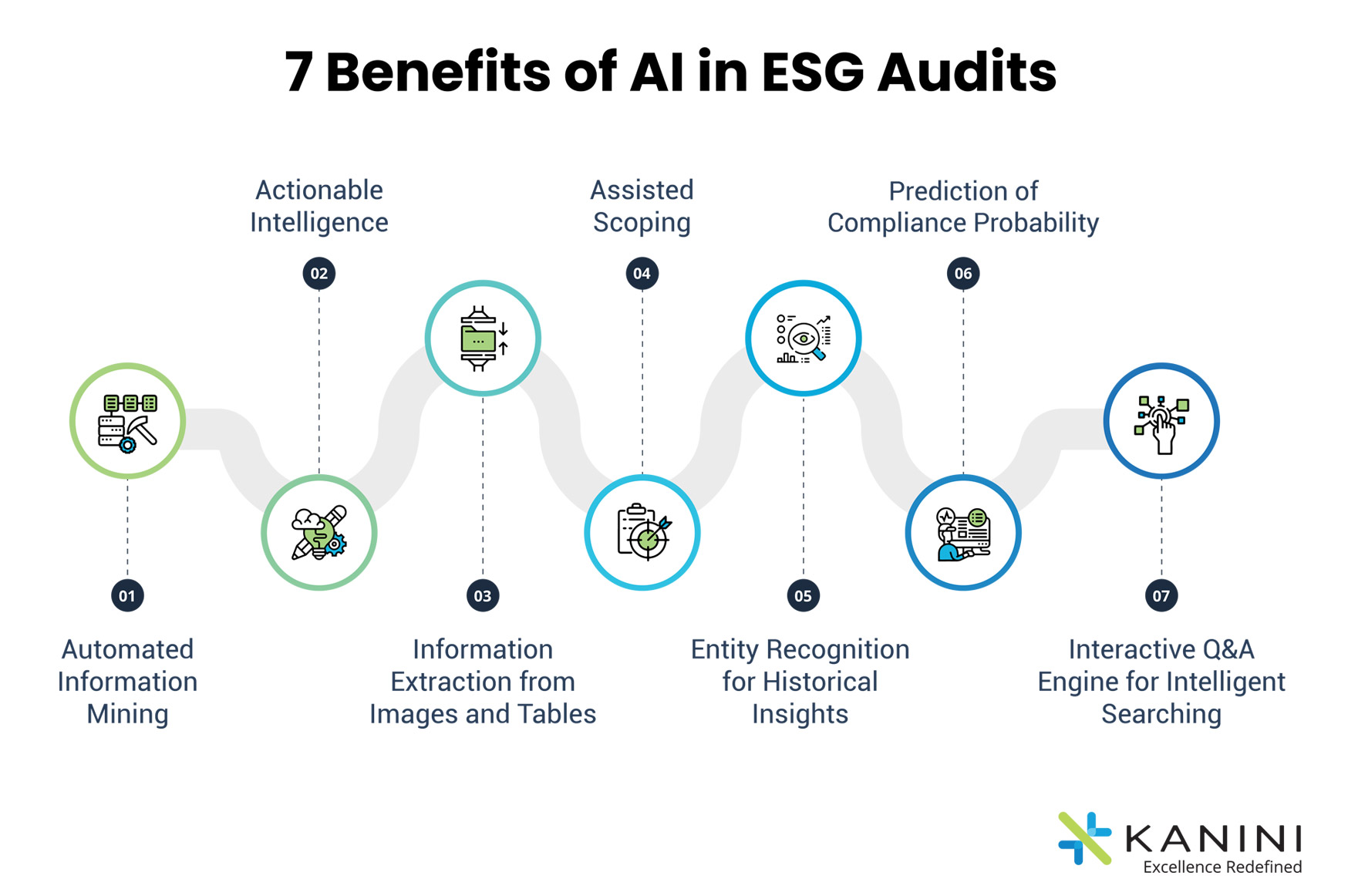

7 Benefits of AI in ESG Audits

Auditing practitioners today are accomplishing high-quality ESG audits using advanced AI-powered ESG Audit Platforms. They can analyze a large volume of documents in the shortest possible time frame and deliver data-driven audit reports. So, AI is proving to be the smarter way of identifying and managing ESG risks for organizations to evolve into more sustainability-focused business entities. Here’s how the AI-powered ESG Audit Platform transformed the requirement completion scoring process for an accurate ESG Score.

1. Automated Information Mining

- The tedious process of information mining is transformed into an automated, seamless, and far more accurate process.

- The practitioners no longer have to spend hours reviewing piles of documents to find what they were looking for.

- All they need to do is upload the bulk of CSR documents, and the ML algorithms present top matching paragraphs along with their “matching confidence scores” and the overall confidence score (aggregate of individual scores).

- The practitioners can then ‘Preview’ the document to cross-verify facts, approve/reject suggestions, and even key in their suggestions.

- The Human-AI Feedback Loop combines all these inputs, re-calculates the overall confidence score, and delivers accurate results.

2. Actionable Intelligence

- The AI-powered ESG Audit Platform empowers the practitioners with “actionable intelligence”, presenting matching phrases from the CSR documents and delivering a data-driven confidence score.

- Practitioners can add information from their subject matter expertise to ML suggestions – the platform uses it to improve algorithm performance in the future.

- Practitioners can review, accept, or change the completion score while reviewing disclosure status to drive a consistent, optimal Engagement Requirement process across all engagements.

3. Information Extraction from Images and Tables

- The intelligent system is also capable of extracting valuable data embedded within images – diagrams, infographics, and tables – across CSR documents.

- During the manual process, the practitioners have to spend a lot of time going over large documents, identifying information embedded in such images, and noting down the important points presented in the pictures (charts/graphs/tables, etc.).

- This information embedded in images contributes greatly to the decision-making process and improves audit quality.

4. Assisted Scoping

- The manual process results in inconsistent scoping by different practitioners for clients in the same industry. This is detrimental to the audit firm’s reputation.

- The automated system allows practitioners to upload historical CSR documents. The ML API parses these documents for all Standards, Topics, Disclosures, and Requirements and reduces the practitioner’s time/effort in going over a large volume of documents to find out topics, disclosures, and requirements during the ‘Scoping’ process.

- Practitioners are able to review scoping suggestions easily and approve selections and take further actions.

- The result is a Faster Turn Around Time of Engagement Scoping Process, and reduced repeated manual tasks for practitioners.

- The AI model ensures a consistent and automated scoping process across different practitioners.

- The modern system also allows the practitioner to change/update information manually if needed.

5. Entity Recognition for Historical Insights

- Auditors often want to understand the trend of CSR compliance of their clients from historical data presented to them. Manual analysis is a humongous task, while an AI-powered ESG Audit Platform very efficiently analyzes a bulk of documents to present past engagement statistics.

- The platform extracts relevant information using entity recognition, stores all the extracted data in an analytics repository (Synapse/SQL DB/Cosmos, etc.), and reports a trend of compliance and information over a period via a visualization tool.

- This gives the auditors far better actionable intelligence, enriches client interactions, and improves the overall quality of service delivery.

6. Prediction of Compliance Probability

- To complete the scoring process, auditors must measure client compliance for every requirement. The manual process for this is intensive, time-consuming, and must be repeated every time a client undergoes an audit.

- The AI system uses past engagement information and data to provide insights to auditors.

- Machine learning clusters and identifies ideal compliance measures for client types based on industry, asset types, etc., and this significantly improves the audit quality.

- The system further predicts the probability of compliance with individual requirements and provides a ranking order of requirements that the auditors need to focus on for the current audit.

- It also allows the practitioners to provide feedback on the validity of the prediction and uses that feedback loop to improve models.

7. Interactive Q&A Engine for Intelligent Searching

- Auditors often have questions and in the absence of an automated system, they have to go through all the CSR and other documents to find answers.

- The Q&A API allows the practitioner to ask questions in free flow text and provides contextually matching answers.

- The ready reckoner system enables practitioners to quickly search and retrieve contextual answers for questions asked.

- The system can be trained to analyze multiple types of documents.

The impact of artificial technology on the auditing process is therefore tremendous. The AI-powered ESG Audit Platform resolves the hardships of manual processes, and combines technology and the practitioner’s expertise in the right proportions, to make the Requirement Completion Scoring seamless and far more accurate.

AI - The Real Game Changer in ESG Auditing

Socially responsible investing, which is also often called sustainable investing, ethical investing, or impact investing – has become the mantra of businesses today. To ensure that these sustainability phrases truly form the core of a company’s business strategies, ESG audits powered by AI/ ML technology are vital. Automated information mining, assisted scoping, named entity recognition, actionable intelligence, feedback ingestion, and Q&A assistance – are just some of the many things artificial intelligence can offer.

KANINI can help you transform your auditing processes through AI so that you can be on the right track with a data-driven auditing approach. Get in touch today to know more.

Subscribe to get the latest updates from the world of technology.

Author

Anand Subramaniam

Anand Subramaniam is the Chief Solutions Officer, leading Data Analytics & AI service line at KANINI. He is passionate about data science and has championed data analytics practice across start-ups to enterprises in various verticals. As a thought leader, start-up mentor, and data architect, Anand brings over two decades of techno-functional leadership in envisaging, planning, and building high-performance, state-of-the-art technology teams.