Trends in Fintech in 2021

Autonomous Finance:

The FinTech industry has paved the way for wealth building by better saving techniques. The integration of AI has proved to be beneficial for the calibration of the financial destination of customers. Using predictive models and AI, Fintech is able to take decisions and actions on the organization’s behalf.

Autonomous finance will help organizations with automated investment management, payments, and the handling of savings. Historically, these services have been done by insurance agents, relationship managers, and financial advisors but Fintech and AI have made it available without the burden of extra manpower.

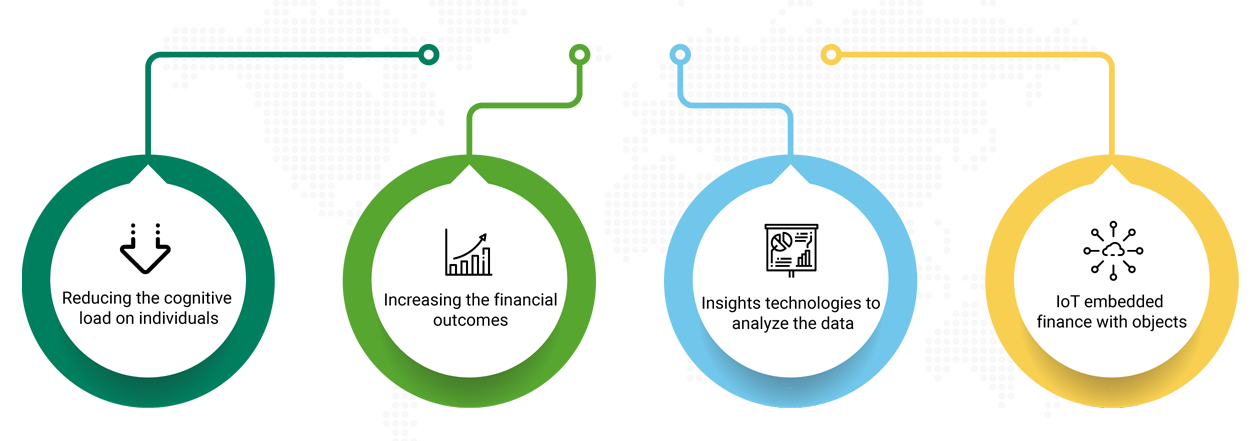

The Benefits of Autonomous Finance Include

IoT can help interact objects and infrastructure with monitoring, analytics, and control systems using an internet-like network. Commerzbank has developed a prototype that is based on a “pay-per-use” loan. This technology uses sensors in capital equipment to automatically adjust the loan terms.

Popular Fintech Services

Here are the services that are gaining popularity in 2021 in the FinTech industry. These services are being adopted by businesses and firms in almost all niches.

Artificial Intelligence:

Artificial Intelligence and Machine Learning has become pivotal in the technological evolution of businesses. Not only this, but they have also become a crucial part in decreasing the operational costs of firms by 22 percent. This has been possible due to reliability, enhanced customer-focused strategy, and AI-driven data analytics. This makes organizations smart by knowing the needs of customers.

Biometric Security Systems:

The adoption of biometric scanning in security systems is increasing due to FinTech. Biometric data not only provides contactless authentication but increases the reliability and fool proofing of the systems.

Open Banking:

Banking and FinTech have joined hands to provide open banking services. Open banking has generated more than $7.29 billion in 2018 and the projection indicates the growth of this industry to $43.15 billion by 2026. Open banking system provides customers with a consolidated view of their financial accounts. This allows the customers to make better decisions, lowers the debt, and improves long-term wealth generation.

Blockchain:

The introduction of blockchain in financial transactions has become more open and transparent. The transactions have become much more secure and increased the trust of customers in the FinTech industry.

Digital Collaborations:

The rise of the pandemic has increased the number of employees working from home. This increase has demanded the use of digital collaboration tools for businesses to get connected with employees in a better way.

Organizations require digital tools for safe and secure access to files and data. There must be encryption techniques that ensure data integrity. Similarly, businesses require an Application Programming Interface (APIs) for better availability of data and communication among coworkers.

There is also a growing trend of Identity and consent management. The technology is built to enable continuous user authentication with password-less authentication, decentralized digital identity, and the ability to recognize identities of machines or Robotic Process Automation.

Digital Only Banking:

Fintech ventures have done a great job in reducing the pain points of customers by making payments simple and slick. Big players are investing in this, for example, JP Morgan has introduced Chase in October 2020. This new platform provides “quick-accept” services which allows firms to process credit cards through mobile apps or contactless readers. Jamie Dimon, the CEO of JP Morgan, has said that the banks need to invest in AI and Machine learning to accelerate the shift towards cloud-based banking. Similarly, they need better ways to attack the new market and customer base.[1]

Decentralized Finance:

Decentralized finance or DeFi is seeing exponential growth in recent years. These decentralized finance companies work outside the centralized financial structures, cut out intermediaries, and democratized finance. It removes banks, payment, and investment intermediaries and replaces them with a blockchain network.

According to Ivan on tech, the DeFi market has grown by 1,000% in the year 2020. It is valued at $680 million at the start of 2020 and has grown to $6.7billion by August. Deltec Bank has viewed the saving industry, assets management industry and trading platform to be affected by DeFi. DeFi has enabled a total of $1.5 billion earning interest across nine crypto markets.

Predictive Analytics:

Using AI and machine learning, predictive analysis will provide an in-depth outcome to particular actions based on past behaviors. Financial organizations deal with an enormous amount of data which is both structured and unstructured. The data can be organized and made useful by identifying trends and risks associated with decisions.

Financial organizations also need a method to deal with structured data like loan applications, tax forms, and bank statements.

The primary aim of big data management has become the useful management of data, to analyze it through good data analytics tools for identification of opportunities in the market, and optimization of products and services according to consumers’ needs.

Acceleration in Financial Inclusions:

No-Code Platforms in Fintech:

The No-Code platforms are the platforms where programmers and nonprogrammers can create applications using Graphical User Interfaces instead of traditional coding procedures. The no-code platforms are on the rise and formed a market worth more than $3.8 billion. This figure is expected to increase to $21.2 billion by 2022.

No code platforms provide FinTech companies the opportunity to create applications and innovative solutions for businesses without the need to code. The process of creating an application through a no-code platform has the following potential benefits:

- There is an appreciable reduction of developmental effort.

- The process is swift and has a fast turnaround when compared to the traditional app development procedure.

- The process can be even done by non-technical personnel

- The features are customizable and cross-platform integration is possible

No-code platforms provide an opportunity to create apps more swiftly, have great customization options, and provide an interactive user interface thus increasing the user base.

Rise of Fintech Services:

The skillful combination of existing technologies has provided the way for popular FinTech services. For example, blockchain has emerged due to Bitcoin as a system of handling Bitcoin transactions, however, blockchain technology has provided a financial system that is more secure and transparent, thus winning people’s trust and loyalty.

Moreover, the current crisis has paved the way for IT-based ventures which are pivotal in the efficient management of employees and communication of co-workers. Banking transactions are done more and more on smartphones.

Similarly, the use of AI in FinTech has paved the way for data analytics providing custom services to customers based on their interests. Crowdfunding and social lending are the brainchildren of the FinTech industry.

Hence, it no longer seems to be optional for financial services providers to include FinTech technology in their operations, but mandatory if they want to stay ahead. Effectively tapping into FinTech will not only streamline processes and build a customer base with trust and loyalty, but also increase profits and futureproof the organization.

Author

Anand Subramaniam

Anand Subramaniam is the Chief Solutions Officer, leading Data Analytics & AI service line at KANINI. He is passionate about data science and has championed data analytics practice across start-ups to enterprises in various verticals. As a thought leader, start-up mentor, and data architect, Anand brings over two decades of techno-functional leadership in envisaging, planning, and building high-performance, state-of-the-art technology teams.