The loan and automation industry is on the precipice of disruption. Particularly after the advent of the pandemic, loan companies are forced to adopt solutions that allow them to disburse loans to customers faster and frictionless loan experience and also are vested with the responsibility of making sure that the loan is disbursed to the right customer who has the potential to payback. Government acts like CARES, PPP and CIBIL are being leveraged by many ailing businesses to get loans for either running their business or paying their employees and the expectation is increasingly becoming “Give the loan Now”

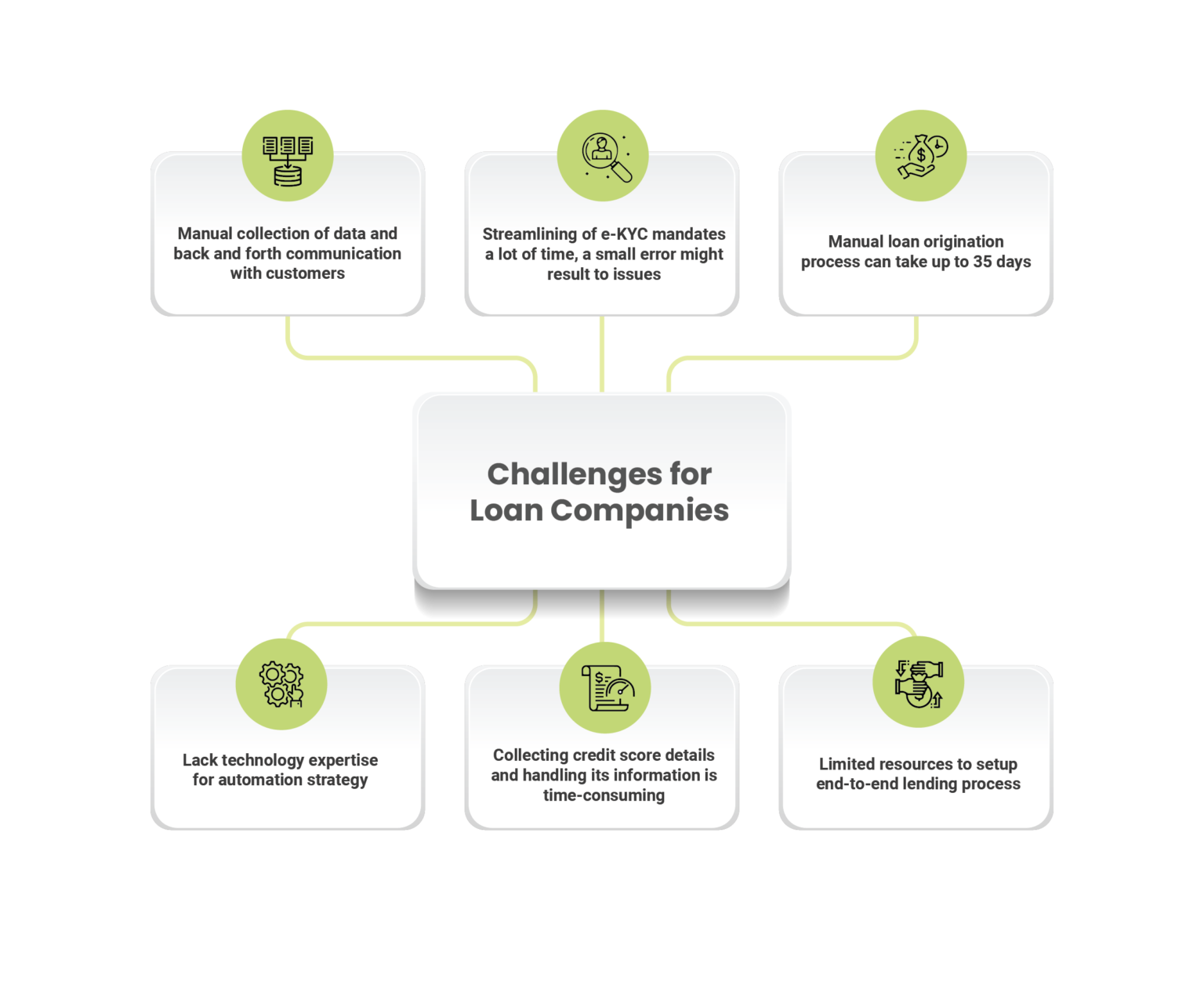

Challenges for Loan Companies

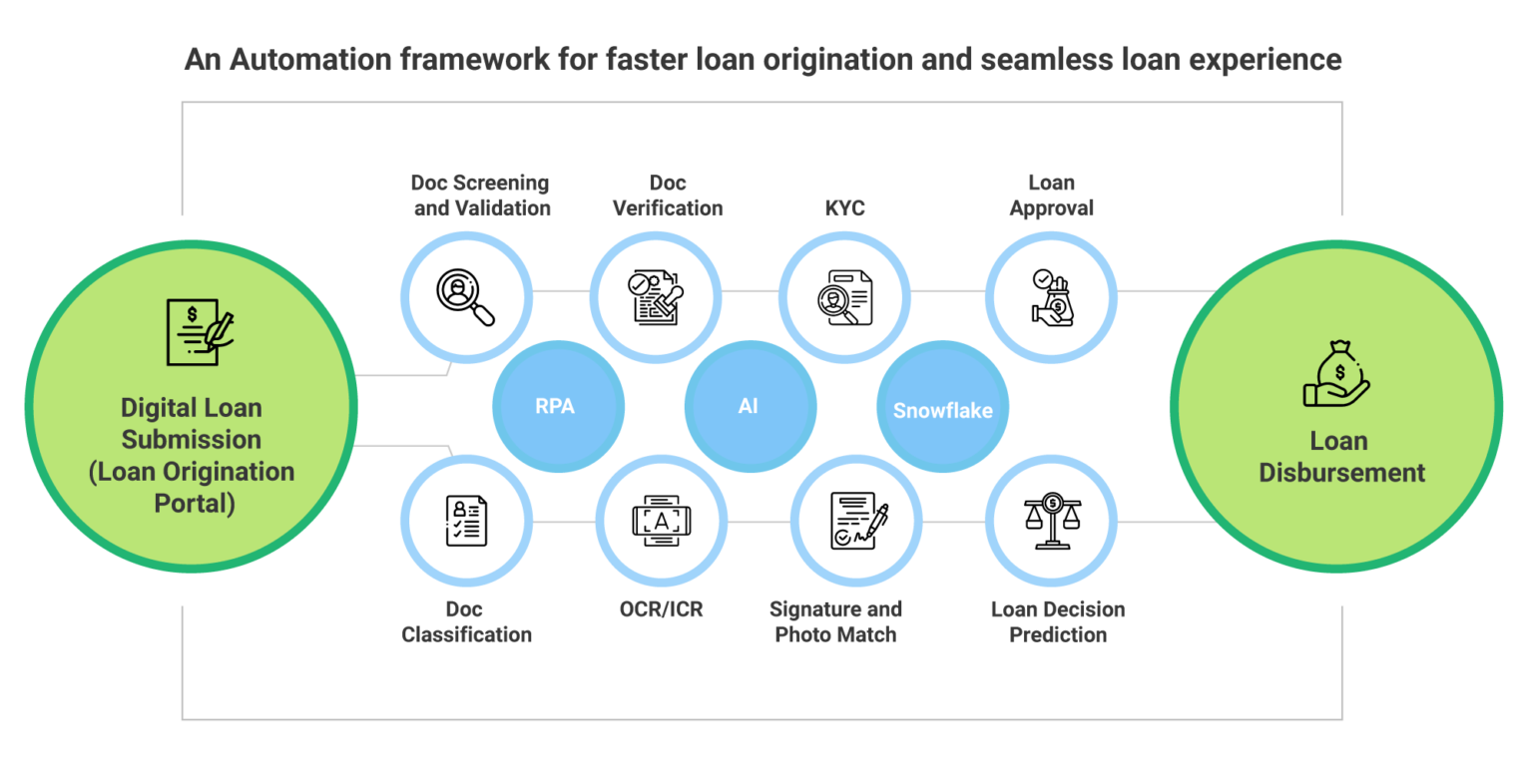

Loan companies are looking for improved customer experiences by building stronger digital platforms that can integrate cognitive solutions to bring down loan processing time related to document screening, verification, and validation. This handles the customer side of the story.

At the same time, loan companies are realizing that there are parameters beyond the credit rating of a customer to be looked at before deciding to approve or reject the loan.

This would mean, loan companies have to put together a robust, scalable, reliable, and “Eyes on Glass” data and analytics platform that allows them to understand, analyze, segment customers effectively, and use their past data to approve or deny their loans.

Startups like Lenddo is helping banks to disburse loans, by considering data points like battery life in their mobile phone to determine creditworthiness.

It’s impossible for a rules-based system to look at all the above and make critical decisions because the above data points can be very temporal in nature.

So, the need of the hour is a platform that can effectively ingest data in real-time, allowing for real-time processing and decision, integrate with an AI service that can effectively classify customers based on various parameters, and provide advice to the loan office to approve or deny a loan.

Snowflake is a very powerful candidate for such a use case and much more.

Snowflake is one unified data platform that can combine the power of data lake, data warehouse, database (data mart). Its ability to run in memory allows us to have an “Always-On Data Pipeline” or snowflake calls it “Continuous Data Pipeline”.

Solution

Last but not the least, Snowflake’s unique data democratization capabilities allow for seamless, relevant, and immediate data sharing amongst various users.

Given the need for faster and accurate loans, every bank or loan management company would eventually need to move to a cloud platform sooner or later. And, Snowflake is a great candidate for moving to the cloud to digitize mission-critical processes, modernize governance, compliance, and reporting, while having an unfair advantage of delivering highly personalized experiences.

At Kanini, we guide our customers with an innovative engagement model and an approach to Snowflake’s Data Cloud that eliminates data silos so you can access virtually all your data in a single, globally available cloud platform. As a result, you can transform your loan management and other financial endeavors through data. You can securely share live, governed data from multiple on-premise and cloud-based systems, across lines of business, subsidiaries, and with partners. Make data-driven decisions, while meeting compliance and regulatory objectives.

Author

Anand Subramaniam

Anand Subramaniam is the Chief Solutions Officer, leading Data Analytics & AI service line at KANINI. He is passionate about data science and has championed data analytics practice across start-ups to enterprises in various verticals. As a thought leader, start-up mentor, and data architect, Anand brings over two decades of techno-functional leadership in envisaging, planning, and building high-performance, state-of-the-art technology teams.