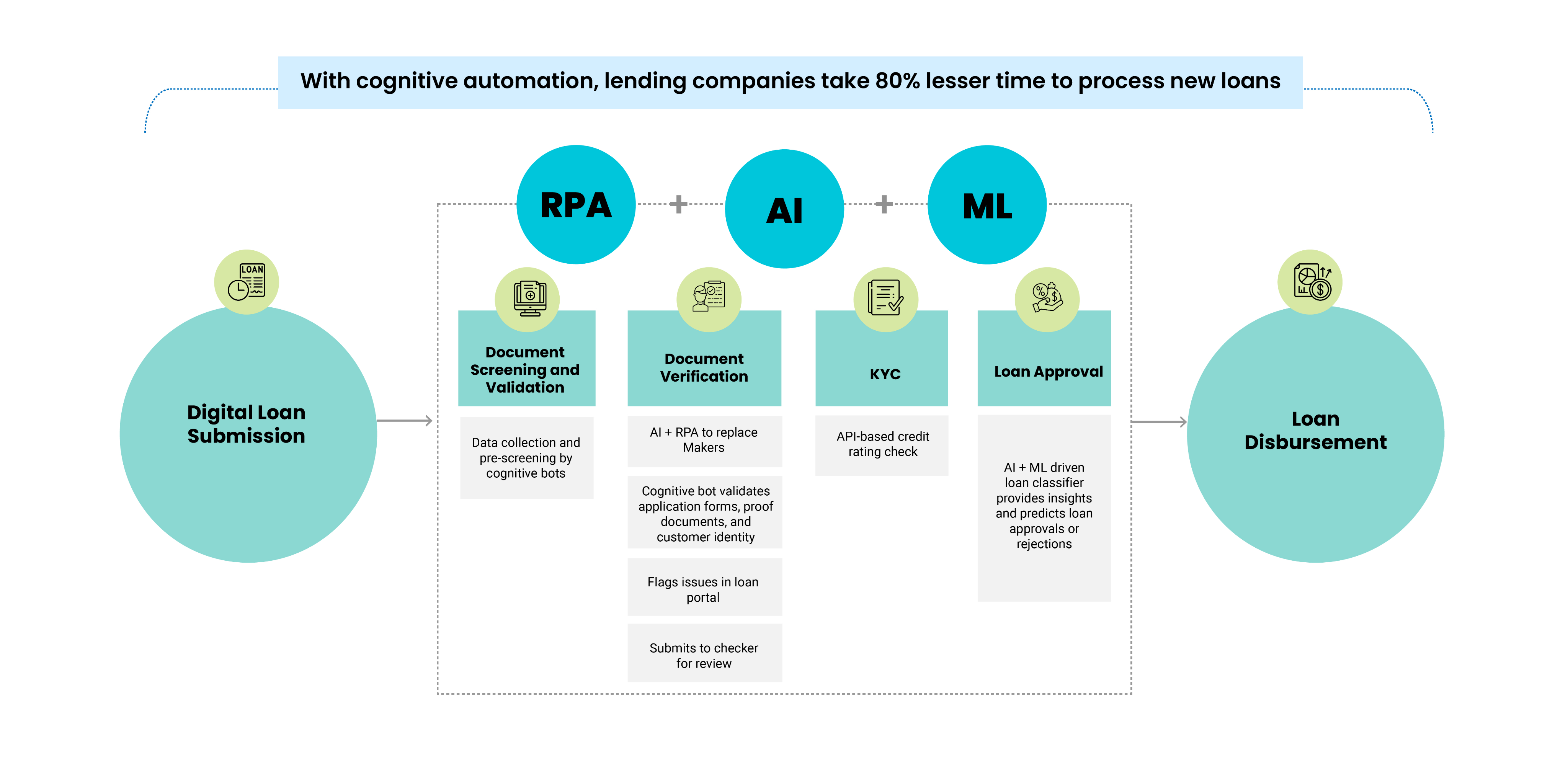

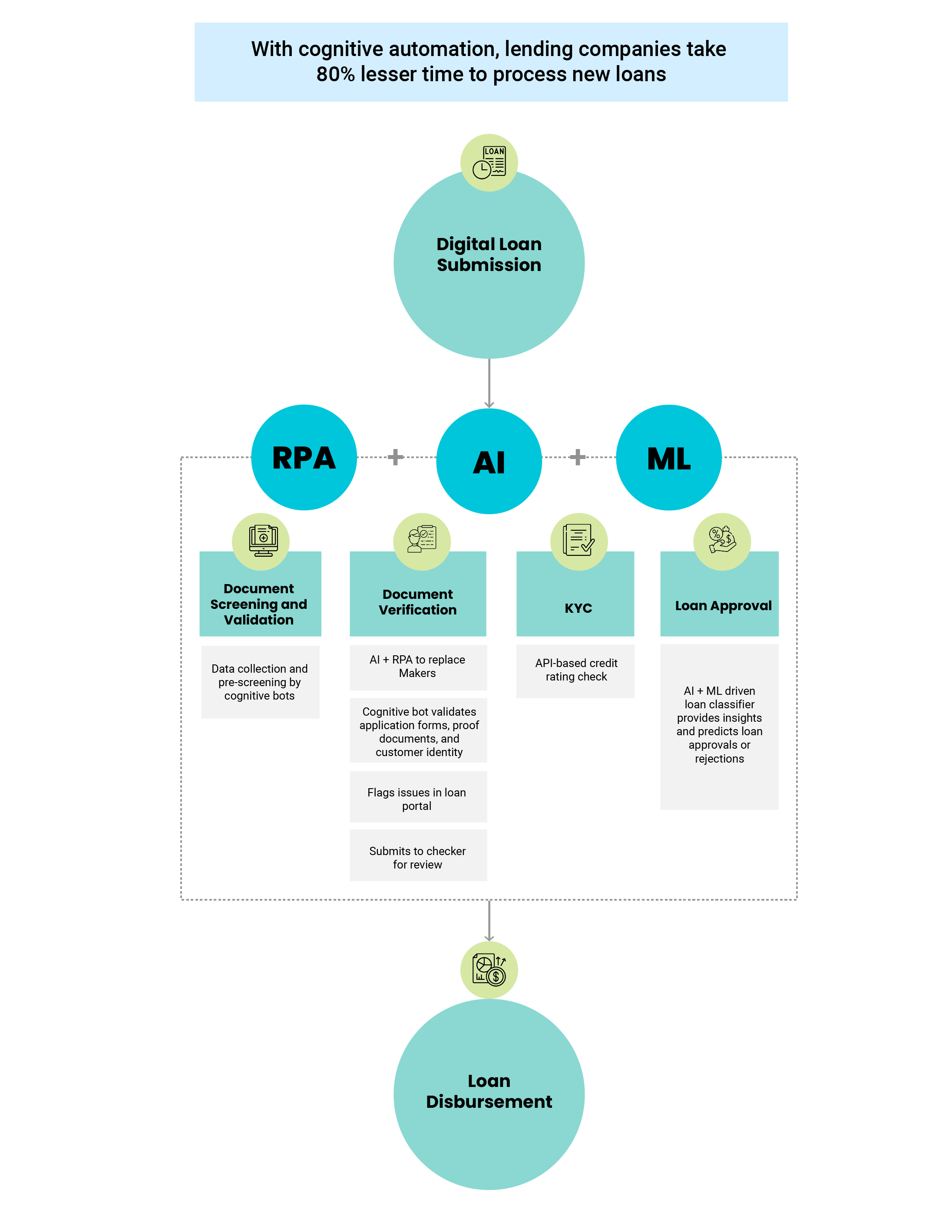

CognyLend.ai, a cognitive automation solution powered by Artificial Intelligence (AI), Machine Learning (ML), and Robotic Process Automation (RPA) capabilities, seamlessly integrates with a lender’s loan management system and helps them accelerate the loan processing.

Seamlessly extract customer data from multiple sources – salary slips, financial records, and so on. Pre-screen applications efficiently with automated data extraction.

Verify and validate loan applications and proof documents, replacing the traditional maker- checker process. Enhance workflows consistently through the self-learning capabilities of ML.

Disburse loans to eligible customers through advanced analysis. For credit score validation, replace rule-based KYC with AI-driven KYC, which also analyzes customers’ past data and Patterns.

Reduce the manual effort and the time taken to perform repetitive tasks in loan processing that cut down operating costs. Minimize errors in the verification process that eliminates the scope for any unexpected loss.

Get recommendations on loan products with loan analytics. And, get a 360-degree view of the customer and relevant data points in a single dashboard to acquire better customer Intelligence.

Gain actionable insights and predict loan default probability based on customer payment history. Auto-classify loan applications and categorize them to identify the type of loans effortlessly and approve/reject loan applications.

Improve Operational Efficiency & Enhance Customer Satisfaction

It helps predict the loan default probability of a customer more accurately and make informed decisions on disbursements based on a scoring system – default probability score, KYC eligibility score, loan eligibility score, thereby reducing the turnaround time. CognyLend provides loan analytics that can provide recommendations on optimizing your products and services in line with customer requirements.

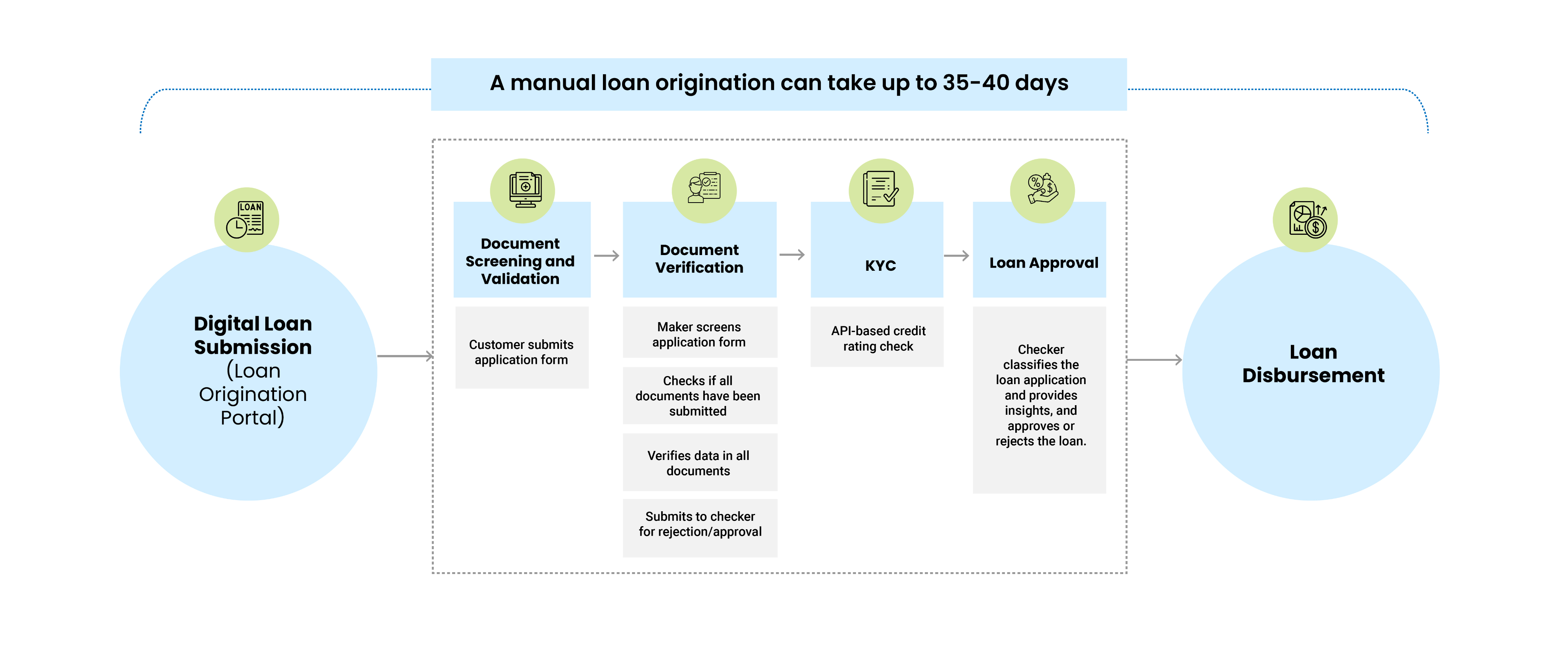

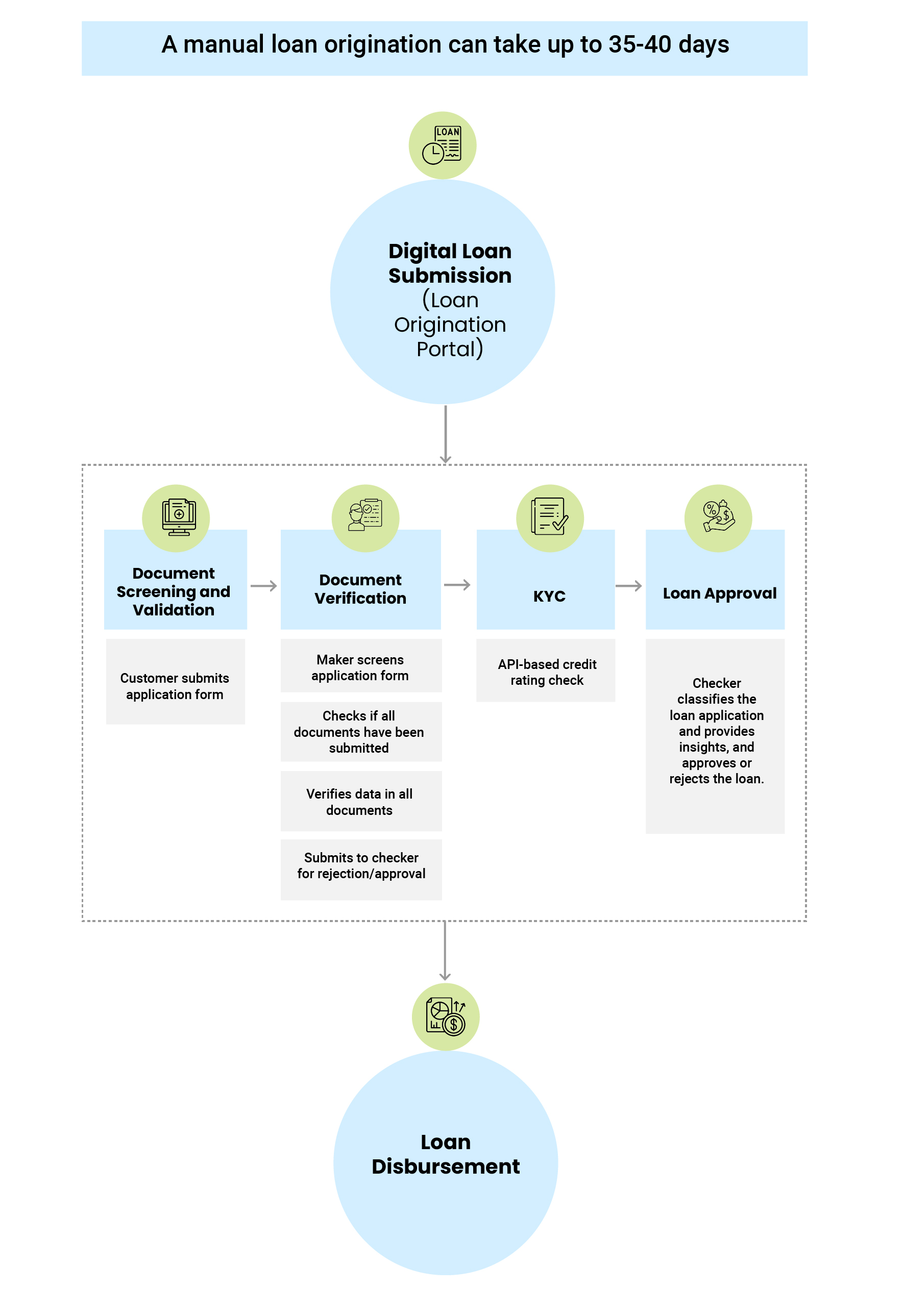

CognyLend automates the loan origination process end-to-end, streamlining the siloed systems and workflows at every stage while ensuring reliable audits and controls.

CognyLend helps in the faster and

automatic screening of customer applications, and identity proofs, bringing more efficiency to the “Maker-Checker” process.

CognyLend provides loan officers with advanced customer

insights and recommendations on loan products and also enables them to predict the probability of loan default by a customer.

Automation, Cloud, AI-driven Insights – more than “Dreams of the Future” these have become the “Demands of the Present”, to set the stage for a business to be truly digital.

Our Services

Contact Us

Newsletter

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |