Migrating to the Cloud is a big decision that requires careful planning. Banks and financial services have unique data security and compliance concerns when it comes to making that move, but the benefits of cloud migration are too great to ignore. The COVID-19 pandemic has accelerated cloud migrations, and according to Forbes, 81% of enterprises, that includes BFSI enterprises, have at least one application or a segment of their computing infrastructure in the Cloud today.

The debate on whether BFSI organizations should switch to cloud infrastructure has been almost abandoned, considering most of the fortune 2000 companies have migrated through various cloud providers like Microsoft Azure, Amazon AWS, and Google Cloud.

In this article, we will explore how the banking and financial services sector can benefit from cloud migration and modernize their business infrastructure for long-term success.

What is Cloud Migration?

The process of transferring data and applications to a cloud computing environment is called “cloud migration”. A holistic, well-planned approach is essential to successful cloud migration. Gartner advises businesses to consider cloud migration around the ‘6-R cloud migration strategy’—Rehost, Replatform, Repurchase, Refactor, Retain, and Retire—as its key elements.

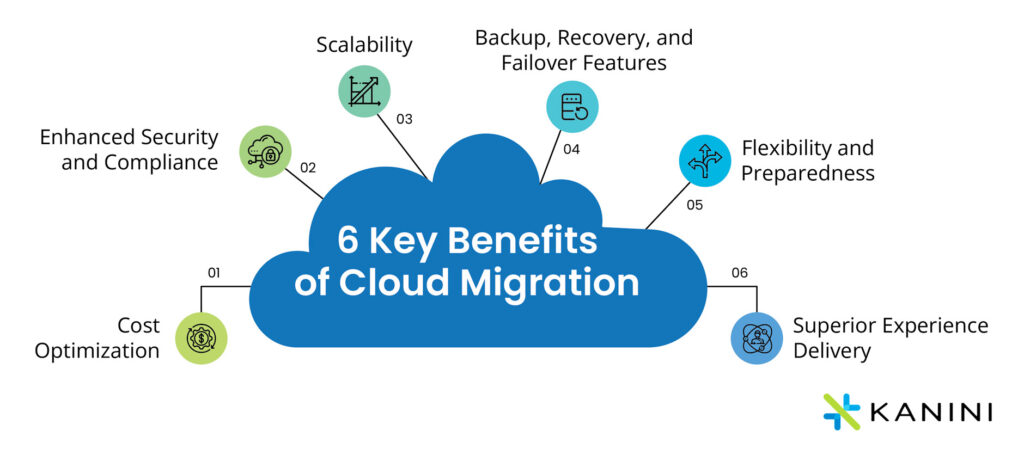

6 Key Benefits of Cloud Migration

As the world is transitioning to the post-pandemic reality, it’s very apparent that Cloud continues to play a part in helping businesses accelerate their digital strategies. Many organizations today realize that the Cloud is a critical element within their overall technology stack.

It’s the cloud’s inherent characteristics such as elasticity, scalability, and high availability, that have made investing in it so attractive for businesses. Organizations looking to strengthen their resiliency find the high availability of the cloud very beneficial, as well as the ability to create backup and disaster recovery solutions at minimal costs than what is possible on-premises.

Let’s take a look at some of the key benefits of cloud migration.

1. Cost Optimization

By migrating to the Cloud, financial services organizations can save on on-premise infrastructure maintenance costs. Cloud resources are highly scalable, and their costs can be optimized based on the need. Cloud also offers a single and unified view to efficiently track usage and manage costs. For optimal cost savings, Banks and FS organizations must evaluate their business needs and match them to the right cloud service model – BPaaS, SaaS, PaaS, or IaaS

2. Enhanced Security and Compliance

In the early days of cloud computing, financial services companies were worried about how safe and compliant it would be to use the Cloud. The BFSI sector was hesitant in moving away from legacy systems and data centers, but cloud providers have addressed most of their concerns. Cloud providers offer tools, security features, and services like automatic security patching to make sure threats to infrastructure and applications are mitigated.

The financial industry is strictly regulated, and cloud giants like Microsoft Azure offer various tools and support to help banking and financial services organizations keep compliant.

3. Scalability

With cloud infrastructure, organizations only need to pay for the resources that they use. With proper design, applications can scale workloads up and down as needed to reduce waste. This ‘’operation-based pricing mechanism and pay-as-you-go model’’ is one of the biggest benefits of the Cloud.

4. Backup, Recovery, and Failover Features

Cloud platforms like Microsoft Azure offer backup and disaster recovery solutions that are secure, scalable, and cost-effective. In the case of any service disruption, accidental deletion, or corruption of data, recovery is often easier in the Cloud.

5. Flexibility and Preparedness

The pandemic showed us that we need to stay alert and agile – prepared to face disruptions. Cloud computing is the most flexible architecture in these types of situations. Employees can access data from all corners of the world, and quickly switch to remote work. Enterprises can ensure business continuity at all times without any worries with a unified cloud platform. That’s a big plus.

6. Superior Experience Delivery

Sustainable business needs to be focused on the customer, and cloud architectures can help. Both customer experience and employee experience get enhanced when financial services institutions use the Cloud. Streamlined operations elevate team productivity, and a stronger grasp of data helps obtain meaningful insights more efficiently for better service delivery.

A Few Challenges While Migrating to the Cloud

● Lack of Strategy and Planning

To effectively plan a migration, you must first evaluate the pros and cons and engage all key stakeholders – including leadership and the IT team. However, many organizations fail to adopt a structured approach, which can be a bottleneck in the migration process. Cloud Migration can be of a single customer app or an entire corporate (Enterprise Resource Planning) ERP system. Careful planning and embracing the 6-R cloud migration strategy makes it all very seamless.

● Cost Constraints

While migrating to the Cloud can boost the ROI in both the short and long term, cloud migration is a gradual process, and it demands time, money, and resources. Therefore, having an estimate and a budget in hand for planning and implementing a migration is very important.

● Business Downtime

Although transferring large data sets to the Cloud can be done quickly, it’s important to keep in mind that there is still potential for some downtime. While taking time to plan the migration process can reduce this risk, it’s often difficult to completely avoid. Therefore, another option is migrating data in waves or phases – this way, only a manageable amount of data needs to be moved at any given time.

● Security and Compliance

Millions of dollars have been lost by banks in the past as a direct result of data breaches. Consequently, data security is essential for financial institutions. A primary concern of banks shifting to the Cloud is data security and breaches that might occur while migrating. Also, compliance laws require institutions to store and use data in adherence to regulatory standards. And organizations fear missing out on any compliance that could cause reputational damage and hefty fines.

● Lack of Skill & Training

Many IT professionals and developers already have the skills needed to migrate to the Cloud, but some additional training may be necessary. Without proper training, the organization may not have the right expertise. Upfront cloud skill development and training can set up an organization for success during and after the migration process.

Overcoming Bottlenecks

The best way to overcome these common migration bottlenecks is to have a reputable migration partner onboard. Choosing a provider that specializes in cloud solutions for banks and FS enterprises is recommended as they have the right experience and expertise for the institution to overcome these challenges and reap the benefits of the Cloud computing platform.

Moving Ahead with Times

A McKinsey survey of nearly 450 Chief Information Officers (CIOs) and IT decision makers globally finds that a subset of organizations has shifted a majority of IT hosting to the Cloud on time and within budget. The present and the future of the banking and financial services industry is the Cloud and when done right, migrating to the Cloud can prove to be a game changer for organizations.

There are numerous benefits of Cloud migration. Team up with a trusted cloud enablement & migration services partner to choose the right cloud service model, embrace a robust migration strategy, and get going. KANINI helps financial services enterprises of all sizes transition to the Cloud, leveraging Microsoft Azure’s cloud platform for enhanced scalability, reduced costs, exceptional security and compliance features, and effective analytics. To begin your cloud migration journey today with KANINI, reach out to us.

Author

Robert Claypool

Robert has 16 years of experience in software development and spatial data analysis. Since 2012, he has been managing our Windows and Linux cloud infrastructure on AWS and Azure, and as Director of Applications Development, he oversees systems architecture, security, and DevOps practices across the organization.