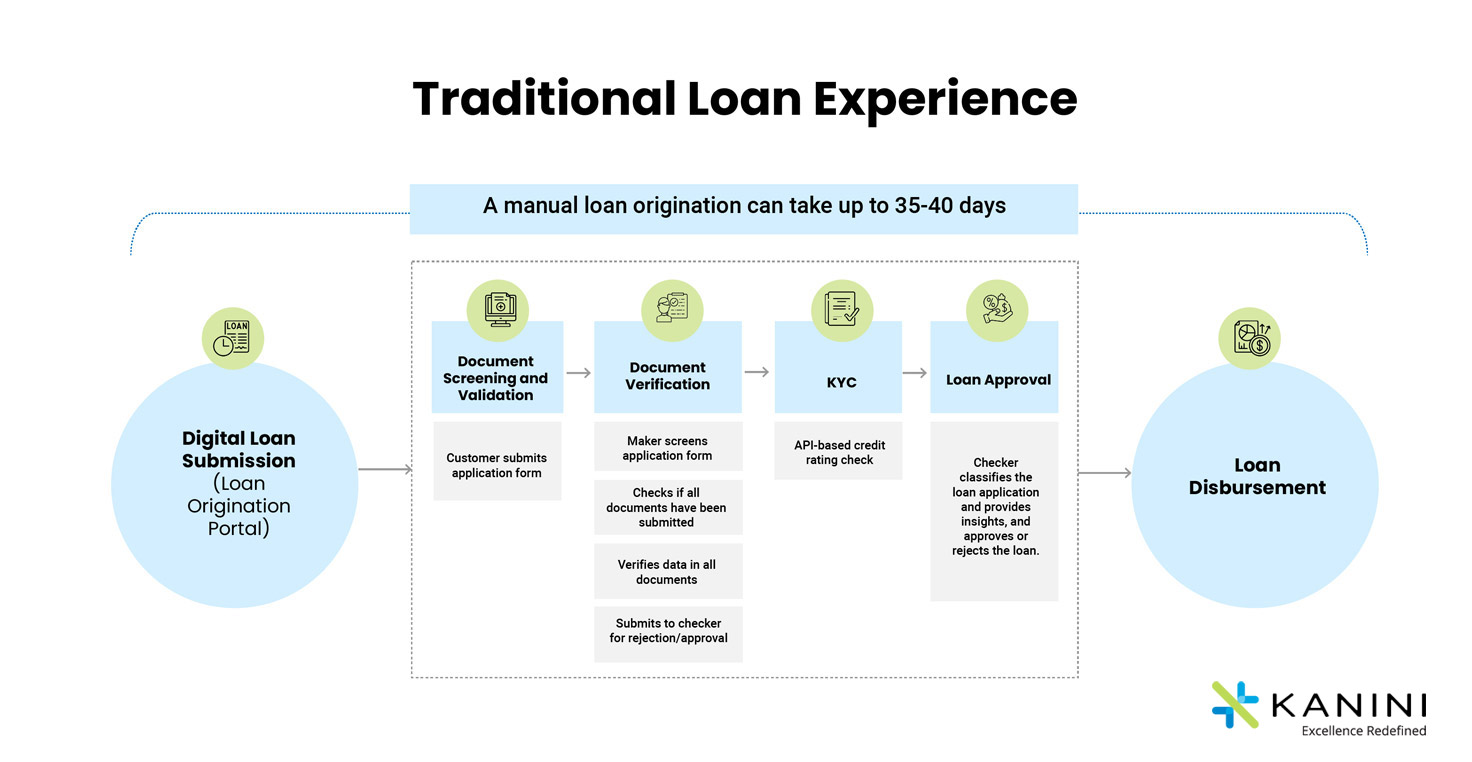

The lending companies such as banks, financial institutions, and FinTech companies find it challenging today to stay ahead of the curve due to the momentum of change. The loan origination process traditionally has been manual as it involved 100s of pages of documentation to validate, verify, know the applicants and then to approve or reject them.

Traditional processes can be highly paper-based, lack consistency, accuracy and consume a lot of time. Existing financial institutions and almost all newly raising small and medium fintech companies are increasingly mindful of decision efficiency, productivity, and above all customer experience. Automation is the only way to allow for streamlining of siloed systems and processes, and workflows at every stage of the origination process while delivering reliable audits and control benefits.

There is a surge in inquiries for loans by the small business administration and loans under the government support initiative like CARES act. From document screening, verification, KYC, and approvals, the loan origination process gets clunky considering every loan package typically has more than 500 pages of documents to be processed. With intelligent automation, AI & ML, loan origination can be quicker and error-free.

This process needs to be automated so that lending companies can close more qualified loans faster with much higher operational efficiency.

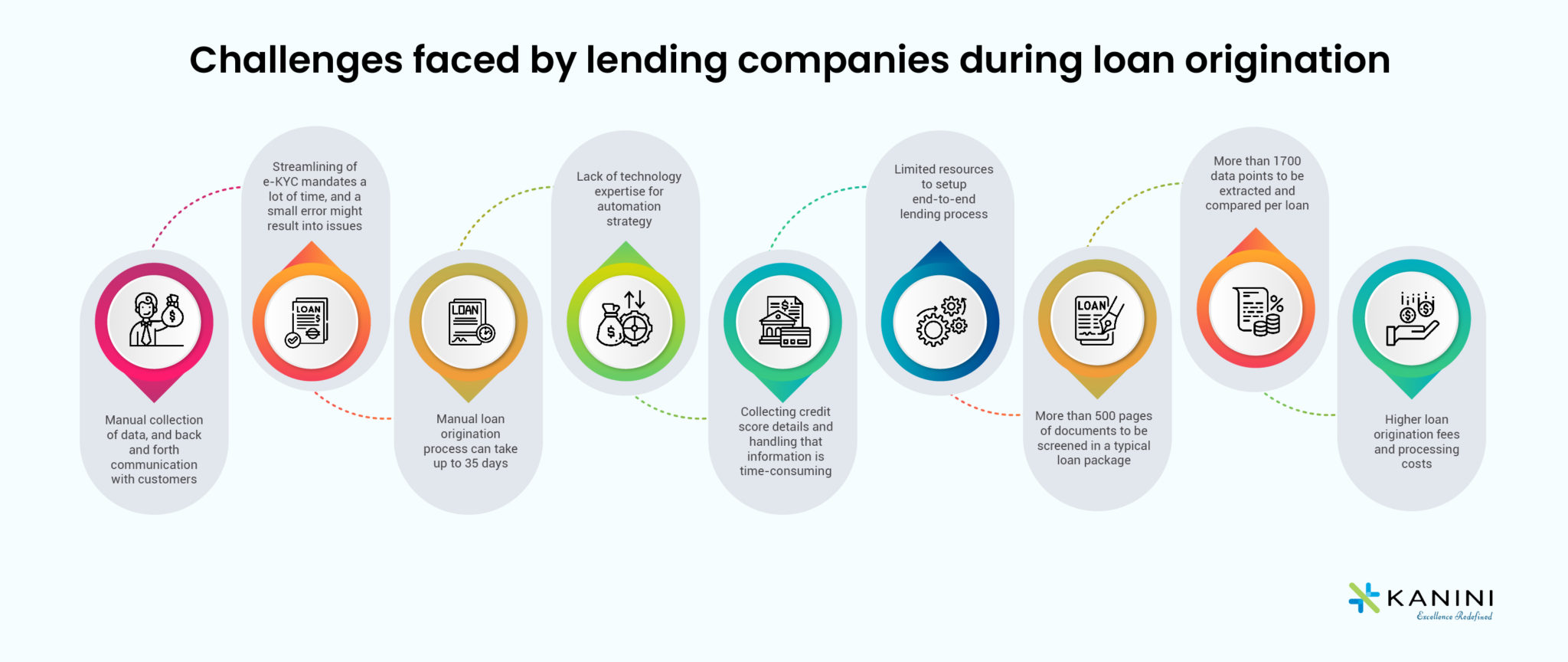

Challenges faced by lending companies

Lending companies need to make a plethora of decisions one after another. On average, they have to extract and compare close to 2000 data points per loan. With manual data collection and the iterations in getting the documents right, further KYC, and verifying credit score details, loan origination processes take over a month to process. And it costs lending companies over $7000 per loan.

Gaining accurate information is a challenge too for lending companies. A lot of time gets wasted in processing the wrong information. Hence, collecting relevant information is the first step to getting the decisions right. Standardized information formats can help organize information for easier retrieval.

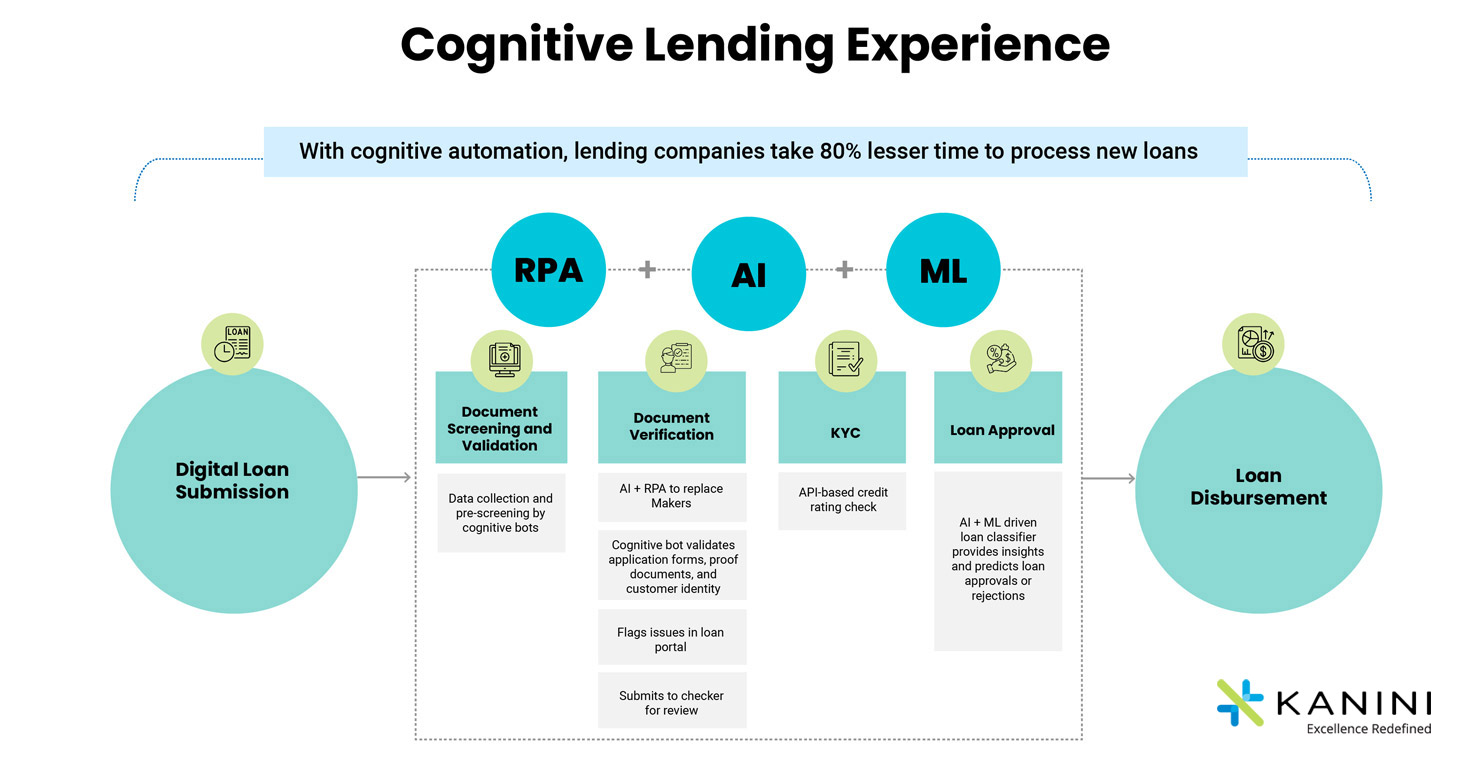

What is Cognitive Lending?

- Captures all kinds of documents from handwritten to digital information

- Combines AI and RPA to validate documents and customer identity

- Checks credit rating leveraging APIs

- Categorizes applications that enable quicker decisions with a built-in loan classifier

Want to learn more about how implementing cognitive automation can help accelerate loan origination and disbursement?

Traditional Loan experience vs Cognitive Lending experience

Benefits of Cognitive Lending

Cognitive lending when built over a strong data platform provides incredible advantages to the lending and mortgage companies.

Lending companies should focus on building a strong foundation for a robust data platform with a thorough data discovery exercise.

Leveraging Cognitive Automation for lending brings a host of advantages to the lending companies:

- Enhance customer experience – Provide a seamless experience to meet current customer demands with consistency across all touchpoints throughout the loan origination process.

- Reduce operating costs – Bring down operational costs with higher data accuracy without impacting quality, customer service, or process efficiency.

- Make underwriting decisions faster – Gain a competitive edge by closing on loans faster and catering to various customer segments at scale.

- Meet compliance consistently – Detect fraudulent behavior early and minimize the fines and process customer requests.

- Improve employee engagement – Go paperless and automate workflows end-to-end and enable employees to close on more loans and assist more customers at scale.

- Use analytics for continuous process improvement – Get higher visibility into your processes and bottlenecks to continuously improve the lending experience.

Conclusion

So, the benefits of “Cognitive Lending” are real and more visible to enterprises as they break down silos and approach them as part of their overall digital transformation strategy.

Buy-in from executive leadership and all stakeholders, investments in automation talent, and clear change management plans can build an inclusive culture for successful automation initiatives. Building automation to simply reduce headcount would inevitably fail. It’s important to include elements of improvement in productivity and intelligent augmentation of employees to enhance the process experience.

Improved operational effectiveness and employee and customer satisfaction continue to be the key drivers for hyper-automation adoption. Hence, lending companies must revisit their loan origination process and adopt the cognitive lending approach in order to deliver a digitized, resilient loan experience while meeting the new guidelines as businesses return to the new normal.

Author

Jatinder Bedi

Jatinder Bedi is working as a Data & Artificial Intelligence leader at KANINI. He is a Data Science Architect and AI scholar. Passionate about the AI domain, Jatinder has championed the AI practice across verticals for various start-ups during 17+ years of his career.