Implementing a customer-centric approach is significant for enterprises to satisfy today’s market and customer expectations, and the Banking & Financial Services sector is no exception. To be customer-centric is to know your customer well. And for this, it is essential to extensively analyze customer data at various banking touchpoints to understand their behaviors and requirements, and thereby build “Customer Intelligence.”

“What is customer intelligence?”

Customer Intelligence is the “deep know-how of customer” acquired via different facets of customer data (reference/ transactional/social). These data points are typically collected via watching the customer actions through various banking touchpoints (mobile, online, branch, IVR, etc.) and analyzed to get actionable information about customers.

This blog will give you a broader view of the changing Banking & Financial Services (B&FS) industry landscape in terms of delivering customer-centric services, in today’s competitive financial market, amidst the rise of Artificial Intelligence (AI) and how this technology is driving operational efficiency of every business process today, transpiring customer intelligence.

What Do Banks & Financial Institutions Need to Deliver Customer-centric Services?

A modern customer intelligence platform is the key to delivering enhanced customer experience – the mantra for the success of any business today. With traditional data analytics practices, it is difficult to acquire superior customer intelligence. To overcome such limitations and align their services with customer needs and expectations, B&FS organizations must embrace AI & ML technologies, combined with the following data-driven strategies:

1. Customer-Centric Banking Model

2. Robust Data Modernization Strategy

3. Predictive Analytics for Next Best Actions

4. Data-Driven Culture to Keep Pace with FinTechs and Neo Banks

5. Smart Data + Digital Transformation Strategy

6. Cloud Enablement to Capitalize on Open Banking Opportunities

AI/ML Framework for Customer Intelligence

Why is a customer intelligence platform important to your business? Customers today have a plethora of choices when it comes to banking services and the room for creating loyalty is so limited for banks. Customers can easily shift from one bank to another if their volatile requirements are not satisfied.

A strong customer intelligence framework, integrated with modern technologies, is essential in the current business scenario to draw valuable insights from customer data and manage customer relationships efficiently. And, B&FS companies have realized the need for a powerful customer intelligence platform. They now understand that relying on conventional customer data analysis processes may not provide actionable insights and reap the desired results that today’s fast-paced financial world demands. For this reason, financial organizations are rapidly transforming their processes to embrace the latest AI-enabled data analytics.

So, to engage customers at an emotional level, predict their likes and dislikes, assist in tackling fraudulent activities, and gain a competitive edge, banks must turn towards an AI-powered customer intelligence platform.

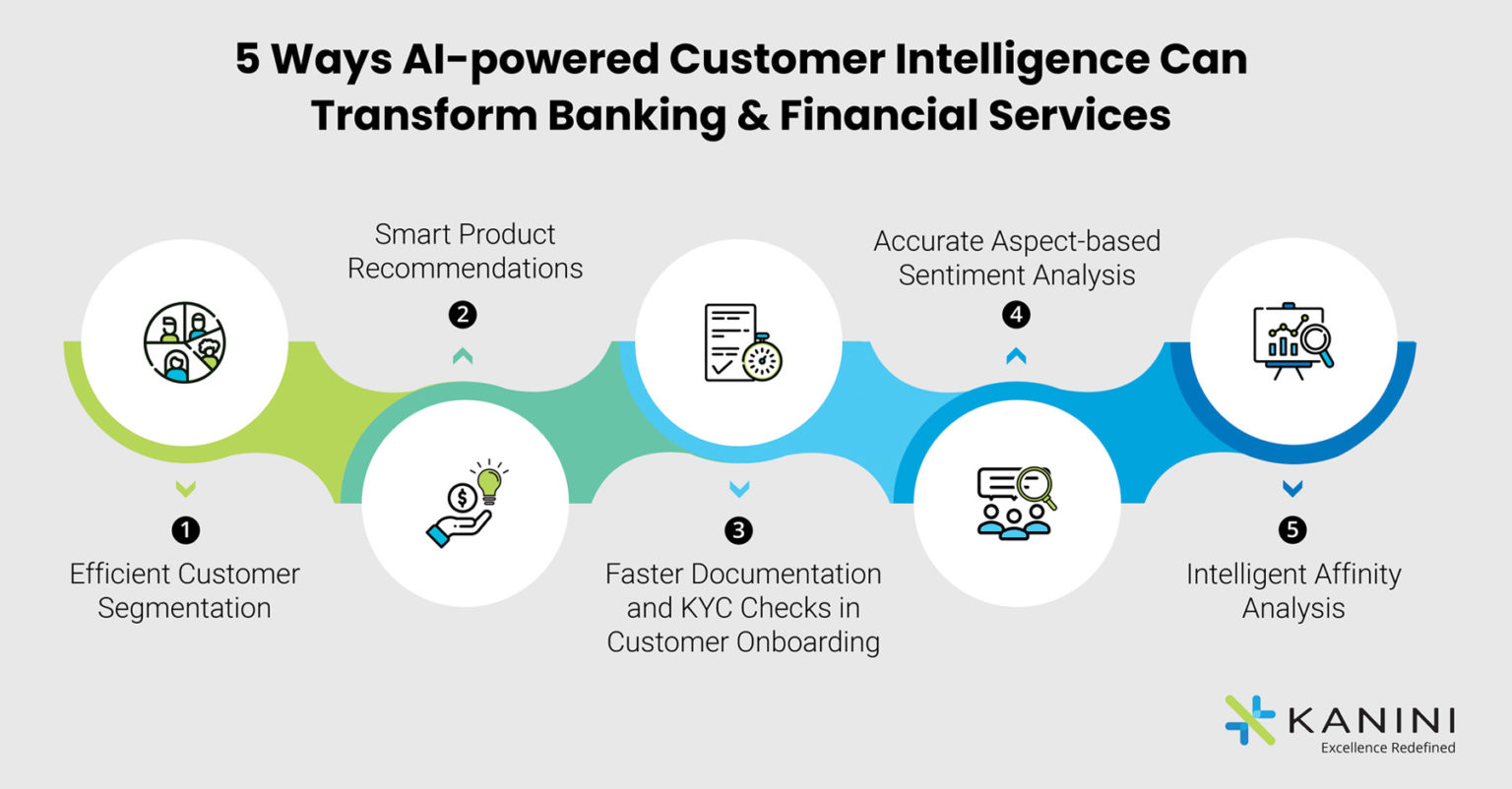

5 Ways AI-powered Customer Intelligence Can Transform Banking & Financial Services

1. Efficient Customer Segmentation

2. Smart Product Recommendations

3. Faster Documentation and KYC Checks in Customer Onboarding

4. Accurate Aspect-based Sentiment Analysis

5. Intelligent Affinity Analysis

The Bottom Line

It is essential to know your customer really well through efficient data analysis and build a robust customer intelligence framework that will help your organization make informed and strategic business decisions for success. An AI-driven customer intelligence platform is what all banks and financial institutions today need to sustain in this highly competitive and dramatically changing business landscape.

If you are looking to build a smart customer intelligence framework to guide your B&FS organization in the right direction towards success through customer retention and new customer acquisition, contact us. KANINI helps banks and financial institutions tap into the revolutionary power of AI/ML techniques to understand customer needs and behavior and serve them better.

Author

Anand Subramaniam

Anand Subramaniam is the Chief Solutions Officer, leading Data Analytics & AI service line at KANINI. He is passionate about data science and has championed data analytics practice across start-ups to enterprises in various verticals. As a thought leader, start-up mentor, and data architect, Anand brings over two decades of techno-functional leadership in envisaging, planning, and building high-performance, state-of-the-art technology teams.